Article Directory

So, you saw some headline about the Bitcoin price hitting six figures and thought you finally understood the crypto game. Cute. You probably read some glossy, sanitized listicle—maybe even one from a place like Forbes—patting you on the back for being so savvy.

They lay it all out for you, nice and neat. Bitcoin, the "digital gold." Ethereum, the "world computer." A whole top-10 list of so-called "blue chips" with market caps bigger than the GDP of a small country. They throw around terms like "store of value" and "utility" to make it all sound so... legitimate. So grown-up.

It’s a comforting illusion. A well-packaged product designed to make you feel safe while you're gambling. And let's be real, that's what this is. But that list? That ain't the real game. It's just the clean, brightly-lit lobby of the casino. The real action is in the back, in a smoke-filled room where the rules are made up and the stakes are insane.

The Sanitized Version They Sell You

I'm looking at this Top 10 Cryptocurrencies Of October 16, 2025—and I have to laugh. It's the same old cast of characters we've been talking about for years, just with more zeroes tacked onto their prices. Bitcoin at $111,318. Ethereum over $4,000. BNB, Cardano, Solana... it’s the crypto equivalent of a classic rock station. They'll play the hits, tell you how great they are, and never, ever mention the new, chaotic stuff that's actually defining the culture.

The pros and cons they list are a joke. For Bitcoin, a "con" is "high energy consumption." You think? We're talking about a network that uses more electricity than some entire nations, and they list it like a minor inconvenience, like "may cause drowsiness." For Cardano, a con is the "slow rollout of features." My friend, Cardano's rollout has been slow since its inception; it's practically a geological feature at this point.

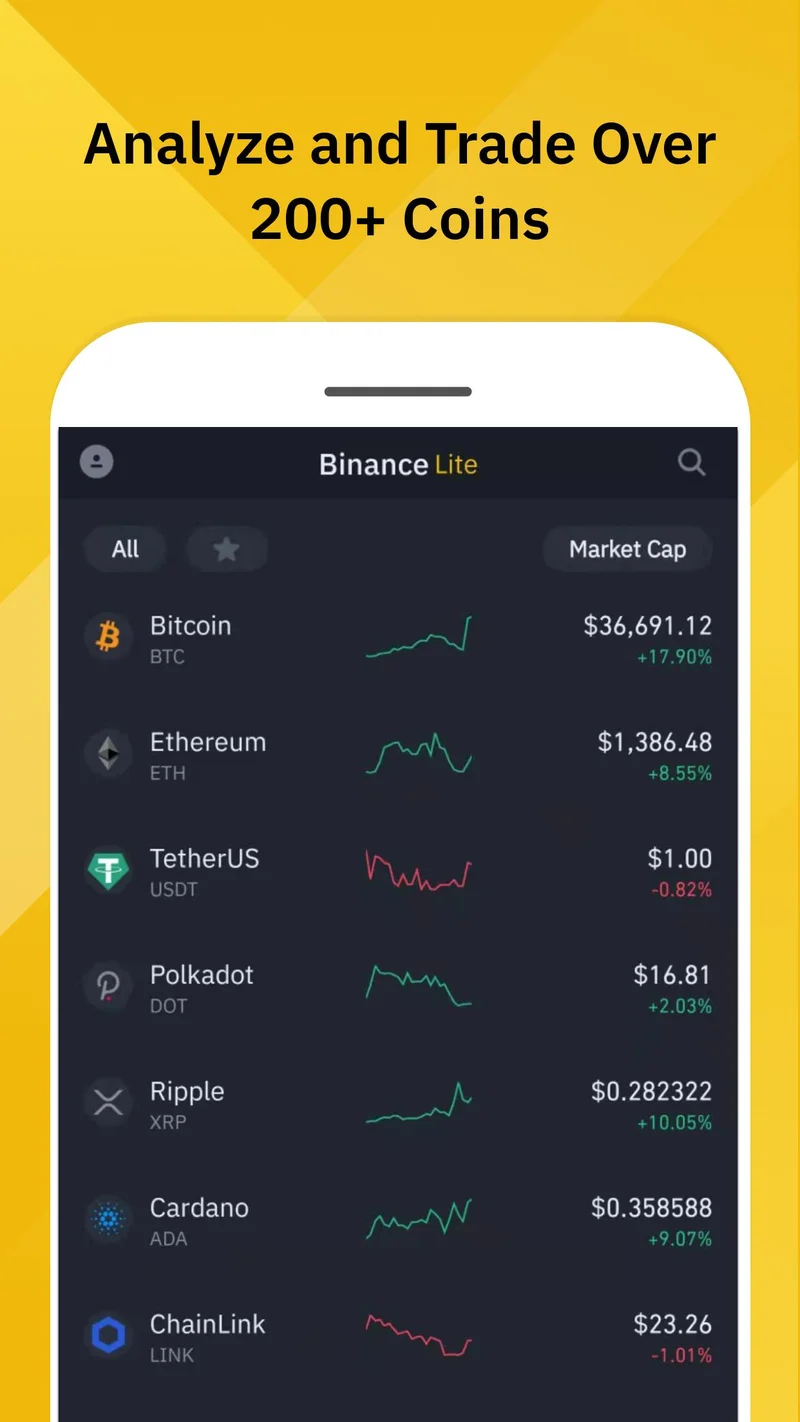

This entire exercise is a masterpiece of normalization. They want you to look at the trillion-dollar market caps and think "stability," but really... it's just bigger chips on the same roulette table. It's the perfect narrative for institutional money and for your uncle who just learned how to buy bitcoin on a mainstream crypto exchange Binance. It makes the whole circus feel like a legitimate asset class.

But does anyone really believe this is the whole story? Are we supposed to pretend that the most innovative thing happening in a multi-trillion dollar industry is just watching the same ten assets slowly get bigger?

Welcome to the Real Degenerate Underbelly

Now, let's talk about the real market. The one that doesn't get a fancy Forbes spread. I'm talking about the cesspool of Top 12 New and Upcoming Binance Listings in 2025. This is where the truth of crypto lives. You can almost smell the desperation and stale energy drinks coming off this list.

Forget "digital gold." Here, we have Maxi Doge, a token that's the "meme personification of a gym-obssessed, 1000x leverage trading Doge." We have PEPENODE, which offers a headline staking reward of 22,302% APY. This is just irresponsible. No, 'irresponsible' is too polite—it’s predatory. It's dangling a winning lottery ticket in front of people who can't afford to lose.

And the names! "Snorter Bot." "Little Pepe." It's like a bunch of 14-year-olds on a Discord server were given a billion-dollar budget. Which, come to think of it, isn't far from the truth. These aren't projects with "utility" or a "store-of-value thesis." They are pure, uncut speculative mania. They're designed to go vertical for 72 hours so the founders and early insiders can dump their bags on a new wave of suckers. It's a complete sideshow, and a dangerous one at that. But its also where the raw, unfiltered greed of the market lives.

This is the engine of crypto. This is the chaos that the "Top 10" list is meant to distract you from. While the suits are busy convincing pension funds that Bitcoin is a hedge against inflation, this is what's actually happening on the ground floor. It's an endless churn of pump-and-dumps dressed up as "the next big thing."

So who is actually buying into a coin called "Maxi Doge" with a straight face? And what does it say about the entire market that these projects can raise millions in a presale in less than a day?

It's All Just a Shell Game

Let's stop pretending. The crypto market isn't two separate worlds; it's one big casino with a VIP section. The "blue chips" like Bitcoin and Ethereum are just the house's chips. They look respectable, they're expensive, and they give the whole operation a veneer of legitimacy. But their value is propped up by the exact same speculative fever that fuels a token named after a cartoon frog. The whole system is a single, interconnected web of hype, greed, and the desperate hope of getting rich before the music stops. Don't let the fancy lists fool you. It's the same game, just with better marketing.