Article Directory

Here is the feature article for the US-based online publication.

*

The Invisible Handbrake: How One Obscure Number Is Quietly Deciding Our Technological Future

I want you to take a moment and think about the biggest, boldest, most audacious technological dreams we have. I’m talking about commercial fusion energy, quantum computing at scale, a fully autonomous transportation grid, the kind of world-changing stuff that feels like it’s perpetually “ten years away.” We have the brains, we have the ambition, and we certainly have the need. So what’s holding us back?

Most people would point to technological hurdles or regulatory red tape. And they’re not wrong. But I believe the single biggest governor on the engine of progress is something far more abstract, a number that flashes across trading desks in New York, London, and Tokyo, a number most of us never even think about: the yield on the U.S. 10-year Treasury note.

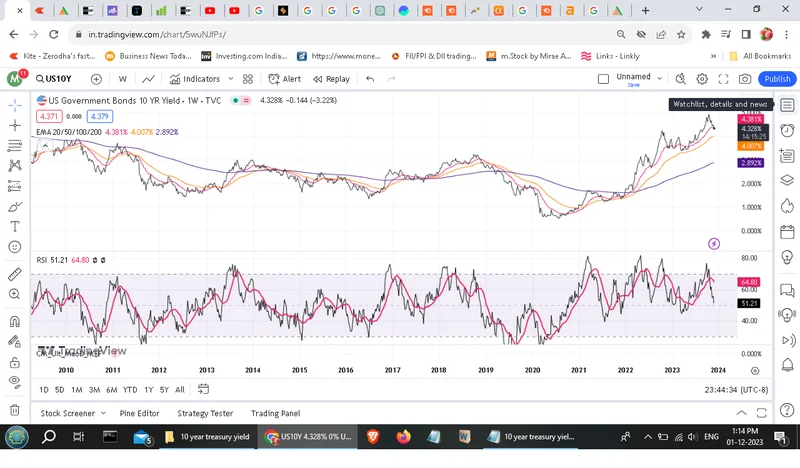

Stick with me here. This isn't another dry financial lecture. This is about the hidden operating system that dictates the pace of human innovation. Because that single percentage point, hovering around 4% right now after a wild ride to nearly 4.8%, is quietly setting the price tag on our future. And when that price gets too high, our boldest dreams get put on hold.

The Global Heartbeat of Ambition

So, what exactly is this number? On the surface, it’s the interest rate the U.S. government pays to borrow money for ten years. But that simple definition hides its true power. It’s the global benchmark for long-term, “risk-free” investment—in simpler terms, it’s the baseline against which every ambitious, risky, and world-changing project is measured. It is the financial world’s resting heartbeat.

When that heartbeat is slow and steady, say, below 2%, the system is calm. Capital is cheap. Investing in a wild idea that might not pay off for a decade seems plausible. But recently, that heartbeat has been erratic. We’ve seen the 10-year yield spike to levels not seen since 2007—before the first iPhone even existed. When I saw the yield flirt with 4.8% earlier this year, I honestly just sat back in my chair, a little stunned. It wasn’t about the stock market; it was about what that number means. It’s a global flashing light of uncertainty, a sign that the world is demanding a much higher reward for taking a long-term risk.

And that has staggering implications. Every venture capitalist weighing a deep-tech startup, every CEO considering a billion-dollar R&D facility, every engineer trying to fund a new battery chemistry—they all have to do the math. And that math starts with the 10-year yield. A higher yield acts like gravity, pulling down the potential return of every other investment. It forces capital to be timid, to seek quick, safe returns instead of funding the moonshots. What’s the incentive to fund a fusion reactor that might work in 2035 when you can get a guaranteed 4% return from the safest investment on Earth?

This is the invisible handbrake. It’s not a conspiracy; it’s just math. The current volatility, driven by a tug-of-war between the Federal Reserve’s attempts to cool the economy and deep anxieties about inflation and government debt, creates a fog of uncertainty. And innovation withers in that fog.

The True Cost of a Volatile World

Think of the incredible technological boom of the 2010s. It was fueled, in large part, by an era of historically low interest rates. Capital was abundant and cheap, creating an environment where investors were willing to take huge bets on disruptive ideas. It was the modern equivalent of the Renaissance, where wealthy patrons gave visionaries the runway to create masterpieces. We got incredible advances in AI, biotech, and private spaceflight because the cost of dreaming was low.

Now, contrast that with today. This isn't just about whether your mortgage will cost more—it's about the mortgage on our collective future, the cost of capital for the labs and factories and server farms that will build the 2030s, and that's a cost that a volatile, high-yield environment makes almost impossible for pioneers to bear. We see headlines about the Fed cutting rates, but as experts rightly point out, the 10-year yield is the real driver for long-term projects, and it’s telling a much more complicated story. The debate over Which impacts mortgage interest rates more: the Fed or the 10-year Treasury yield? Experts weigh in highlights this very point.

Does this mean we need to go back to zero-percent rates forever? Absolutely not. That system had its own deep flaws, creating asset bubbles and exacerbating inequality. This isn’t a call for cheap money, but for stable money. Progress requires a predictable horizon. You can’t plan a decade-long project if the fundamental cost of your capital is swinging wildly month to month. Our current financial climate is forcing everyone to think in quarters, not decades.

So, what happens when the brightest minds are forced to optimize for short-term survival instead of long-term transformation? We get more social media apps and fewer breakthroughs in material science. We get incremental improvements instead of paradigm shifts. The future doesn't stop, but it certainly slows down. And in a world facing existential challenges like climate change and resource scarcity, a delay is a price we can’t afford.

Recalibrating Our Future’s Clock

Ultimately, the 10-year Treasury yield is more than just a financial instrument. It’s a consensus reality, a real-time vote of confidence in our ability to build a better, more prosperous, and more stable tomorrow. Its current volatility is a reflection of our collective anxiety.

But here’s the optimistic take, the one that keeps me going. This is a system built by us, and it can be understood by us. By recognizing this number not as some arcane metric for Wall Street but as a critical piece of data about our own global psychology, we can start having a more intelligent conversation. We can ask the right questions. How do we build a financial system that rewards long-term vision? How do we create stability that allows genius to flourish?

The next time you see a headline about Treasury yields, don’t glaze over. See it for what it is: the ticking clock of our future. And understand that its rhythm is something we all have a stake in setting. The future is arriving, but the speed of its arrival is still very much up for debate.