Article Directory

Vertiv's Stock Is Having an Identity Crisis, and We're All Just Watching the Wreckage

Let’s get one thing straight. The stock market isn't rational. It’s a twitchy, paranoid beast fueled by caffeine, algorithms, and the collective anxiety of millions of people staring at glowing rectangles. And if you want a perfect, textbook example of its bipolar nature, look no further than Vertiv Holdings (VRT).

One minute, the company is dropping a quarterly earnings report so good it should be illegal. The next, the `vrt stock price` is taking a nosedive. I can just picture some poor soul, coffee in hand, watching the premarket numbers soar on the news, only to see the stock open and immediately start bleeding out. It’s the kind of whiplash that makes you want to dump your portfolio and go live in a cabin with no Wi-Fi. What in the hell is actually going on here?

The Numbers Don't Lie, But the Traders Don't Listen

Let's break down the absurdity. Vertiv just posted a monster third quarter. Net sales shot up 29% year-over-year to $2.68 billion, blowing past consensus estimates. Organic orders surged nearly 60%. Their book-to-bill ratio is a beefy 1.4x, meaning they're getting new orders way faster than they can fill them. Adjusted earnings per share? A cool $1.24, smashing the $0.99 Wall Street expected.

They even raised their guidance for the full year. They’re basically standing on the rooftops, screaming, “WE ARE MAKING A TON OF MONEY AND WE’RE GOING TO MAKE EVEN MORE!”

And how did the market react to this glorious news? The stock dropped 2% during mid-day trading on Wednesday (Vertiv (NYSE:VRT) Stock Price Down 2% - Here's Why). Volume exploded to 151% of its daily average as people scrambled to… sell? This makes no sense. No, "no sense" is too polite—this is five-alarm market schizophrenia. It’s like watching a quarterback throw a perfect 80-yard touchdown pass, only for the fans to start booing and heading for the exits.

Are we supposed to believe that the fundamentals don't matter anymore? Is it all just a high-frequency trading game where algorithms react to shadows on the wall? This isn't investing; it's gambling on which direction a panicked herd will stampede next. This ain't like buying `msft stock` and sleeping soundly for a decade. This is pure chaos.

Wall Street's Guessing Game

If you’re looking for clarity from the so-called experts, forget it. The analyst reports on Vertiv are a chaotic mess that perfectly mirrors the stock's performance. You’ve got Goldman Sachs reiterating a "buy." Great. Then you have Mizuho jacking up their price target to $198 with an "outperform." Sounds bullish. But wait, Barclays raises their target to $145 but calls the stock "equal weight," which is Wall Street-speak for "meh." And just to make it a party, Zacks swoops in and downgrades Vertiv from a "strong-buy" to a "hold."

It’s a complete circus. These analysts are like a team of weather forecasters arguing about sunshine while standing in the middle of a hurricane. They’re all just reacting, trying to sound smart after the fact. Their consensus rating is a "Moderate Buy," which is about as useful as a screen door on a submarine. What does that even mean? "Maybe buy it, but also, maybe don't?" Thanks, guys. Super helpful.

And while the analysts are busy throwing darts at a board, let’s look at what the people who actually know the company are doing. Two directors, Jakki Haussler and Steven Reinemund, have dumped millions of dollars worth of stock in the last quarter. Reinemund alone sold over $12.8 million worth, cutting his position by nearly 43%. Insiders sold over $23 million in stock total. Offcourse, the PR line is always "portfolio diversification" or some other nonsense. But when the people in the boardroom are cashing out, it makes you wonder what they see coming that we don't. Maybe they see the same volatility we do and decided to take their winnings off the table before the casino burns down.

The AI Hype Train's Ugly Underbelly

So what’s the real story? Vertiv makes the unsexy but absolutely critical gear for data centers—cooling systems, power management, the plumbing that makes the whole digital world run. With the AI boom, companies like Nvidia (`nvda`) are selling the golden goose, and Vertiv is selling the high-tech coops to keep them from overheating. It's a classic "picks and shovels" play in the new gold rush. The demand is obviously real, as their order book shows.

The company is even leaning into it, announcing a partnership with Nvidia to "revolutionize AI factory power systems." They’re pouring a quarter of a billion dollars into capital expenditures this year to expand production. They’re betting the farm on this AI-fueled growth continuing at this breakneck pace.

But what if it doesn't? The market is treating anything associated with AI like it's a magic beanstalk to the sky, just like it did with `tsla stock` and the EV craze. But every hype cycle has a peak, and a painful correction. Vertiv is now caught in that updraft, and its stock is behaving less like a stable industrial company and more like a volatile crypto coin. They're projecting 26-28% growth next year, which is insane, but after a certain point you just have to wonder...

Then again, maybe I'm the crazy one here. Maybe this really is the new paradigm and the old rules about P/E ratios and market sanity don't apply. But I’ve seen this movie before, and it usually doesn't have a happy ending for the retail investor who buys in at the top.

Just Another Spin on the Roulette Wheel

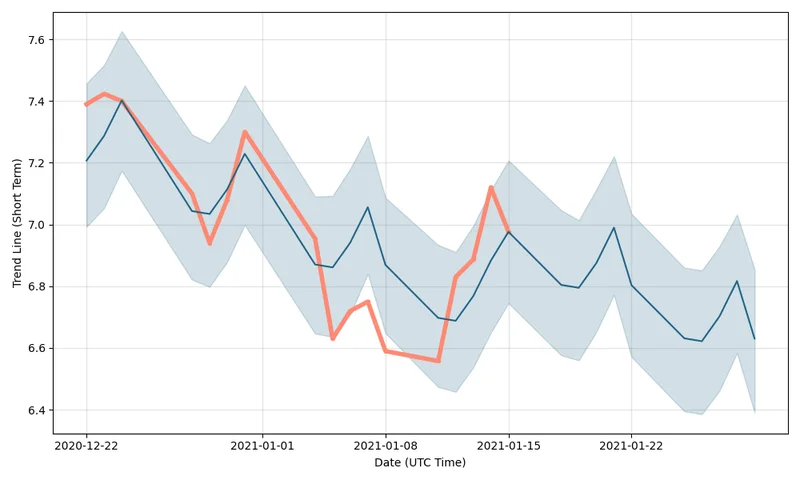

Look, the numbers Vertiv posted are undeniably fantastic. The company itself seems to be firing on all cylinders. But the stock is a different beast entirely. It's become a proxy war between fundamentals and market sentiment, and sentiment is a fickle, irrational monster. The insiders are selling, the analysts are confused, and the stock chart looks like a lie detector test administered to a pathological liar. Investing in VRT right now isn't an investment; it's a bet. It’s a high-stakes wager that the AI hype will outweigh the market's jitters. Good luck with that. I'm keeping my money on the sidelines.