Article Directory

Here we go again. Another week, another analyst trying to tell you Where Will Uber Stock Be in 5 Years?, as if they have a crystal ball powered by spreadsheets and corporate jargon. This time, it’s Uber. You know, the company that’s become a verb. That’s the first line they always trot out. “It’s a verb!” they shout, as if that somehow magically justifies a $192 billion market cap.

Let’s be real. "Googling" is a verb, and `google stock` has fundamentally changed how we access information. "FedExing" is a verb, and it powers global commerce. "Ubering" is a verb for "paying a stranger with a 2014 Camry to drive you three miles so you don't have to find parking." It's a convenience, not a revolution. And the constant drumbeat that its dominance is unshakeable is starting to sound less like analysis and more like a prayer whispered in a boardroom.

They tell you to look at the numbers. 180 million monthly users. Revenue up 18%. A burgeoning ad business pulling in $1.5 billion. It's a good story. No, 'good' doesn't cover it—this is a perfect story, custom-built for a PowerPoint presentation to investors who are desperate to believe in the next `amazon stock`. It’s the kind of narrative that ignores the gnawing reality on the ground: the endless legal battles over driver classification, the paper-thin margins, and the fact that 50% of their users are just hailing a ride once or twice a month. This ain't a daily habit for most people; it's a "my car's in the shop" or "I've had three too many margaritas" solution.

So, will `uber stock price` be higher in five years? Probably. But will it be because of this grand, disruptive vision? Or will it be because of financial engineering and finding new ways to squeeze every last penny out of its drivers and restaurant partners?

The Quant Nerds and Their Shark Gods

Just when you think you’ve got the simple, bullish story figured out, the other side of Wall Street chimes in. Not with fundamentals, mind you. That’s too boring. They come at you with… marine biology.

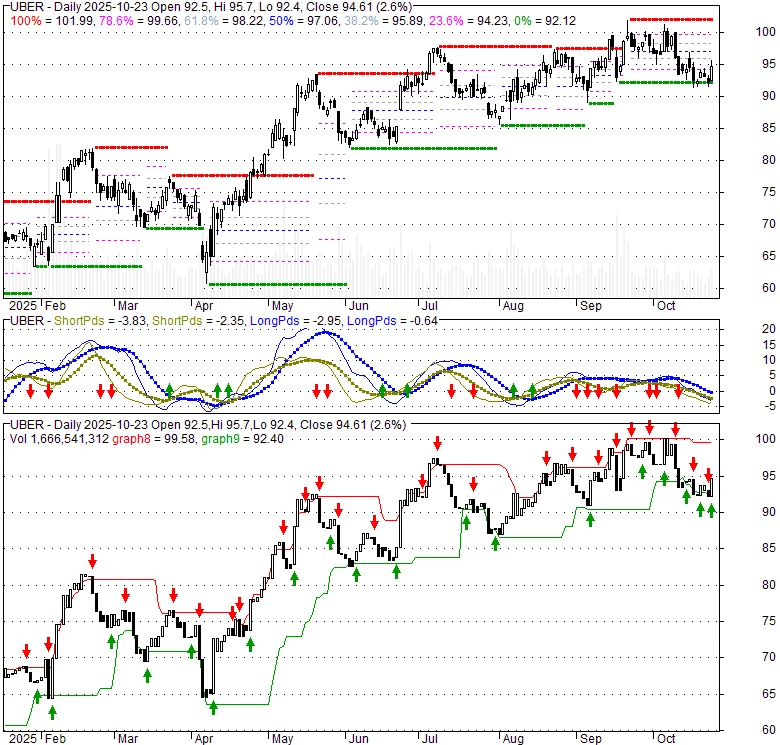

I kid you not. One recent analysis, arguing that UBER Stock is an Unusual Options Candidate But It’s the Quant Signal That’s the Star, compared their method to tagging sharks. They claim that by converting stock charts into "discrete signals," they can identify "behavioral states" just like a great white's migration pattern. This is what we've come to. We're not investing in a company that moves people from point A to point B anymore; we're betting on the "taxonomical" journey of a stock ticker. Give me a break.

The signal, they say, is a "4-6-U sequence." Four up weeks, six down weeks, but an overall upward trend. This pattern, which apparently accounts for a whopping 3.47% of all patterns, is a contrarian green flag. It has a "72.7% exceedance ratio." It's all so scientific, so precise. It feels like they're reading tea leaves and just using bigger words. Honestly, this stuff reminds me of when my cousin tried to get me into crypto by explaining the zodiac signs of different coins. It’s a cult, just with more calculus.

So the "smart money" is apparently betting against the stock in the options market, but the really smart money—the shark-tagging quant geniuses—are saying to bet on it because of a rare pattern that sounds like a license plate number. What is a regular person supposed to do with this? It feels like two different high priests arguing over which entrails predict a good harvest. And we're supposed to put our retirement money on the line based on their...

It's All Just Noise

Here’s the thing nobody wants to admit: both of these arguments are just sophisticated forms of gambling. One side is betting on a story, a narrative about network effects and becoming the "Amazon of transportation." The other is betting on a statistical anomaly, a ghost in the machine that says "buy now."

The storytellers point to `tesla stock` and say, "See! A charismatic leader and a good story can defy gravity for years!" The quant jockeys point to complex models and say, "Trust the math, not your feelings." But neither of them really knows a damn thing. They can't predict the next pandemic, the next regulatory crackdown, or the next tech disruption that could make Uber look like a taxi company with a fancier app.

The whole game is rigged to make you feel stupid if you don't play along. You’re supposed to pick a camp. Are you a "fundamentals" guy who believes in the five-year plan, or are you a "quant" guy who believes in the 4-6-U sequence? It’s a false choice. The real answer is that the market is a chaotic mess of fear, greed, and algorithms, and `uber stock` is just another poker chip on the table. Believing anything else is just fooling yourself. Then again, maybe I'm the crazy one for thinking a simple car-ride service shouldn't be analyzed like a particle physics experiment.

So, Are You Buying the Fairy Tale or the Fortune Cookie?

At the end of the day, you have to choose your delusion. Do you put your faith in the slick corporate narrative that Uber is an unstoppable behemoth destined to own all movement, a story as polished and unconvincing as a politician's smile? Or do you trust the high-frequency shaman who claims to have found a magic pattern in the market's random squiggles? One is a bedtime story, the other is financial astrology. Its all a show, designed to make you feel like you have an edge when, in reality, you're just flipping a very, very expensive coin. Good luck. You're gonna need it.